November 20, 2025

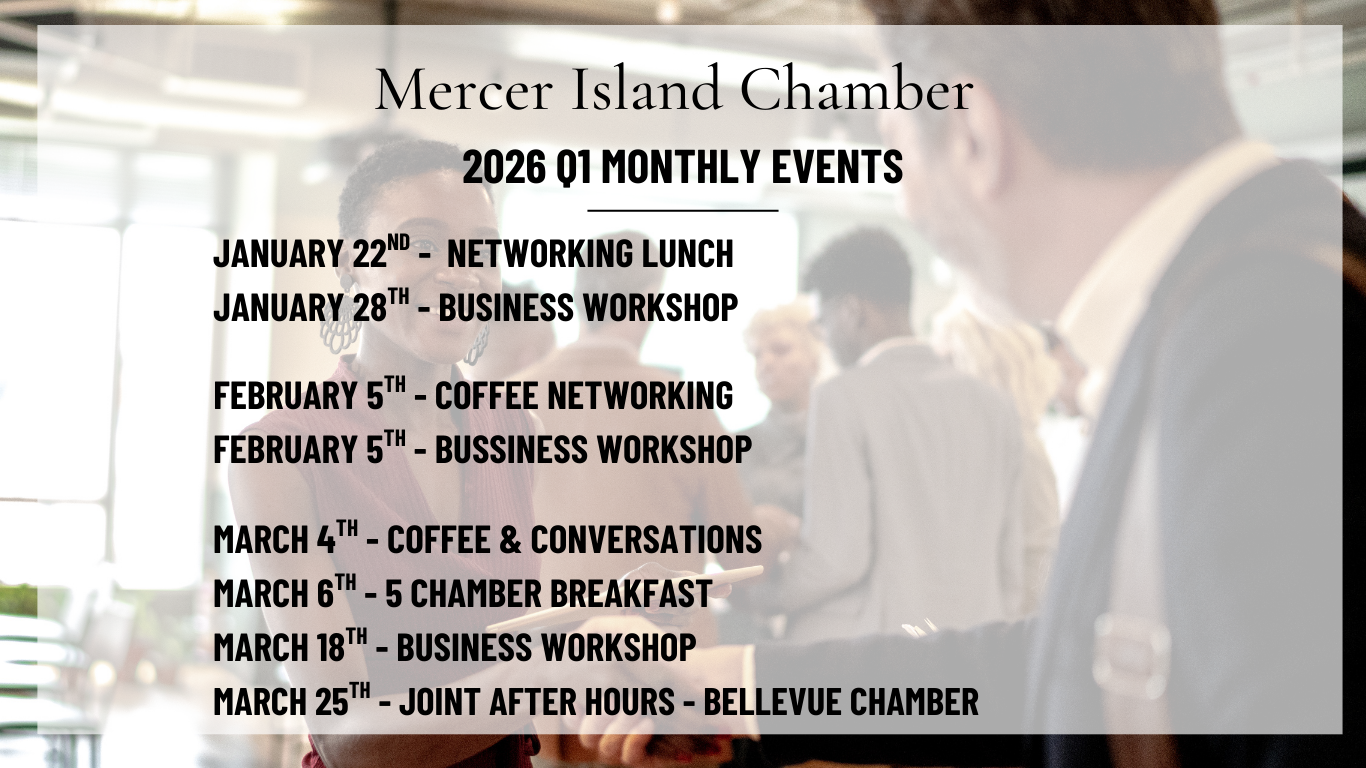

As we enter this beautiful holiday season, I want to share something close to my heart: the power of genuine connection and community building for our small businesses. After more than a decade of networking and bringing business owners together, I've seen firsthand how the relationships we build during the holidays can transform our businesses and our lives. This isn't just about exchanging business cards, it's about creating a supportive community where we all thrive together. Why Holiday Networking Matters for Our Community The holidays offer something special: people are more open, more generous, and more willing to connect authentically. When we come together during this season, we're not just building business relationships, we're strengthening the fabric of our entire business community. We Lift Each Other Up Small business ownership comes with unique challenges. When we network, we create a circle of fellow entrepreneurs who truly understand the journey. These connections become our cheerleaders, our advisors, and our friends. Together, we're stronger. We Expand Our Reach Every conversation is an opportunity to share your story and discover new possibilities. When you authentically connect with others, they become ambassadors for your business, naturally sharing about you with their own networks. This organic growth is powerful and sustainable. We Learn From Each Other Our community is full of wisdom and experience. Through networking, we share insights, strategies, and lessons learned. This collective knowledge helps all of us become better business owners and community leaders. We Create Collaborative Opportunities Some of the most exciting business growth happens when small businesses collaborate. Through meaningful networking, you'll discover partners whose strengths complement yours, opening doors to joint ventures, cross-promotions, and shared success. Simple Ways to Network This Holiday Season You don't need a complicated strategy or perfect pitch. Here's how to connect authentically this season: Join Community Events Look for holiday gatherings, Chamber events, local fundraisers, or business mixers. Come as yourself, with an open heart and genuine curiosity about others. The best connections happen when we're authentic. Reach Out With Gratitude Send personalized holiday messages to your business connections. Share your appreciation for their support and friendship this year. These thoughtful gestures strengthen bonds and keep relationships warm. Create Connection Spaces Consider hosting a casual gathering, a coffee meet-up, a virtual celebration, or a holiday open house. When you create spaces for others to connect, you become a community builder, and that's invaluable. Give Back Together Partner with fellow business owners to volunteer during the holidays. Serving your community together builds deep, meaningful connections while making a positive impact. Always Follow Through After meeting someone new, reach out within a few days. Share that resource you mentioned, make that introduction you promised, or simply say how much you enjoyed meeting them. Reliability builds trust. Lead With Generosity Here's what I've learned at The Networking Bee Group: the strongest networks are built on generosity, not transactions. When you focus on how you can support others, help them succeed, and contribute to the community, everything changes. People remember your kindness. They trust you. They want to collaborate with you and refer others to you. This community-first approach isn't just good for business, it's good for the soul. Your Holiday Networking Action Plan I invite you to commit to three simple actions this season: 1. Attend at least one Chamber or community networking event. 2. Send personalized thank-you messages to five business connections expressing genuine appreciation. 3. Connect two people in your network who could benefit from knowing each other. These small, intentional steps create ripples of connection throughout our entire business community. Let's Grow Together At Seattle Agenda and The Networking Bee Group, our mission is simple: to help small businesses build authentic connections that lead to real growth. This holiday season, I encourage you to embrace networking not as a business task, but as an opportunity to build the collaborative, supportive community we all deserve. When small businesses work together and lift each other up, our entire community flourishes. Let's make this holiday season the beginning of meaningful connections that carry us into a prosperous new year. Here's to community, collaboration, and connection. Lynette VGarcia Blanks